EVs for High-Mileage Drivers

Find out how to get an EV that covers enough miles

Save up to 40% on your next car while reducing your carbon footprint!

One simple portal shows you all of the vehicles your employer includes on your scheme.

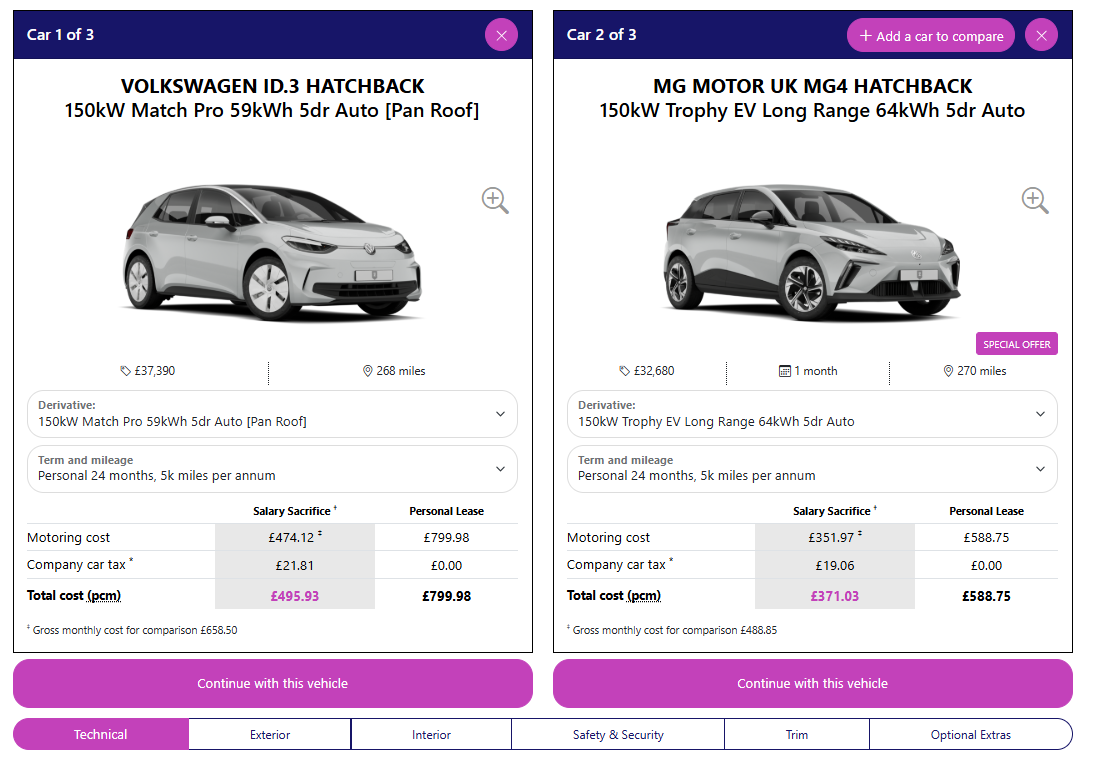

You’ll be able to compare the costs and savings side-by-side of the vehicles you shortlist.

Your employer leases the car on your behalf so there’s no credit check or upfront deposit to pay!

You can log into the portal, browse a range of electric vehicles and customise your lease, selecting annual mileage, lease duration etc. Choose optional extras such as paintwork, wheels, and driver convenience features easily to tailor the vehicle.

The platform includes a savings calculator that shows how much you’ll save through salary sacrifice on a selected vehicle, and can compare different models to help you find the best deal. It lists the features, costs and savings on multiple vehicles side-by-side, so they’re easy to compare.

Our portal tells you how much salary you can afford to sacrifice via an instant affordability check calculator, making it easy to see your budget at a glance when reviewing different vehicles and prices.

You’ll get notified when your order gets approved, as well as other important information including the status of ordered vehicles and when paperwork needs e-signing. It’s all in one place on our straightforward portal.

You don’t pay anything upfront and the monthly payments come from your salary before you receive it.

A full manufacturer guarantee will last for most, if not all, of the contract term, depending on the length of agreement.

We cover routine servicing and maintenance including breakdown, and tyre replacement through wear and accidental punctures.

You get a brand-new electric vehicle leased on a term between two and four years with road tax included for the entire period.

Fully comprehensive insurance including business use comes as standard as part of your salary sacrifice deal with us.

We include early termination protection in case of unforeseen circumstances with leases in place for a minimum qualifying period.

1. Choose your car

Browse the portal to find your perfect salary sacrifice electric car deal with the ability to compare various makes and models, the costs and the savings you’ll achieve. Add any specifications you’d like, including colour and wheels.

2. Complete your documents

e-Sign the salary sacrifice scheme employee agreement for the car through our online portal and send it to your manager for approval. Anything else we should say here?

3. Manager approval

Your manager will check the chosen car is a good fit and if it is, they will countersign your paperwork. It will then be forwarded to your leasing company to approve? are there any other stages that fall between this one and the one above? Can we also have more details here on this stage?

4. Take delivery

Once the salary sacrifice electric car is in stock we'll arrange for it to be delivered to your door. Anything we should add here to flesh out the delivery process in more detail?

Which electric cars are available for salary sacrifice?

All the best makes and models of electric vehicles are available, including Tesla, Audi, BMW, Ford, Volkswagen, Nissan and many more. You can choose from any fully electric and some plug-in hybrid models, with minimal carbon emissions, to qualify for the lowest tax rate and maximise your salary sacrifice savings.

Can I drive my salary sacrifice car for personal use?

Yes. Even though you’re leasing the car through your employer, the car is for personal use rather than as a business company car. Therefore, there are no restrictions on how you use it. One thing that you'll need to be mindful off though is that as the vehicle will be leased so you'll have an annual mileage allowance.

Whose name is the car in?

The lease contract for the car and all associated services will be in the name of your employer. Use of the car is then provided to you in exchange for the amount of salary sacrificed so nothing will be in your name.

What tax do I pay on a salary sacrifice car?

Your salary sacrifice car is deemed a benefit in kind (BIK) and is taxed in the same way as a company car. BIK tax on zero emission electric cars, and those emitting less than 50g of CO2 per km with an electric range of at least 130 miles, is fixed at a very low rate of 3%, increasing by 1% each year until 2028. This makes salary sacrifice a very cost-effective way of running an electric vehicle.

What are the criteria for joining your salary sacrifice scheme?

There are a few criteria that you'll need to meet in order to qualify for a salary sacrifice scheme. The general ones include:

•You need to be a full time or part time employee over 18 years of age.

•You must meet the National Minimum Wage threshold after the sacrificed salary has been deducted. We advise a minimum salary of around £30,000.

•You must also meet the car insurance eligibility requirements shown below.

•Your contract of employment must be for a longer duration than the salary sacrifice agreement (usually two to four years) and you need to be able to commit to the full term of the lease contract.

Your employer may have their own eligibility criteria which will be communicated to you separately.

You should also consider other financial commitments and the impact that the salary sacrifice car could have on any other changes in circumstances.

What does the insurance included with the car cover?

The insurance premium is fixed for the lifetime of the agreement and you will be able to get a full break down of this when you join the scheme. What is and isn’t covered will vary slight by provider but to give you a general idea, the current policy we offer includes:

• Social, domestic, pleasure and commuting cover, including use on your employer’s business, are covered as standard. Other forms of business use for the policyholder and/or spouse/civil partner may be considered on a case-by-case basis, but do not order a car without checking first. Any other drivers listed on the insurance (not partner/spouse) will only be covered for social, domestic and pleasure use.

• Unlimited cover for audio and navigation equipment that is permanently fixed to the vehicle and has no independent power source.

• Personal belongings in the car up to £350.

• Replacement locks (see full policy wording for details).

• Damage to your vehicle following incorrect fuelling (no cover for removal of incorrect fuel and refuelling of the car).

Emergency medical treatment.

• Medical expenses, up to £350 per person.

• Accident transport/vehicle recovery.

• Child car seat cover, up to £100 per seat.

• Courtesy car for the duration of repairs if in case of an accident the car is repaired by an NIG approved repairer.

• If the vehicle is stolen and not recovered or if it is declared a total loss, a courtesy car is provided for up to 14 days or until a settlement offer is agreed (whichever is earlier).

What are the insurance policy excesses?

Just like if you’d taken out an insurance policy yourself, you will be charged an excess if you need to claim. This will be charged through your employer. Excess charges are:

• Accidental Damage £250

• Fire, Theft and Malicious damage £250.

• Replacement windscreen £50. There will be no excess charge if the windscreen is repaired.

• An additional excess of £300 applies to drivers aged 17 to 20 for each claim and £200 for drivers aged 21 to 24.

What are the insurance eligibility rules?

You must be between 18 and 75 years of age (78 at the end of contract). You must have a full driving licence from the UK, EU, EEA or one of the following countries: Andorra, Australia, Barbados, British Virgin Islands, Canada, Falkland Islands, Faroe Islands, Hong Kong, Japan, Monaco, New Zealand, Republic of Korea, Singapore, South Africa, Switzerland, USA or Zimbabwe.

You must be a permanent UK resident and have been a permanent employee for a minimum of 6 months, or a named driver for a permanent employee. You are allowed no more than 2 category 'A' convictions disclosed and no more than ONE FAULT claim per driver disclosed in the last three years. Claims or category ‘A’ convictions over three years old from the car delivery date are acceptable, as are convictions that are shown below in red, which are over five years of age from date of delivery. No drivers have a non-motoring conviction that is not spent under the Rehabilitation of Offenders Act.

No drivers can be employed by the emergency services unless explicitly agreed.

No drivers are celebrities or otherwise in the public eye including professional sportspersons, actors and musicians.

Category ‘A’ Convictions show on online licence checks beginning with the following codes: CU or LC or MW or PC or SP or TS.

Please note If you have any of the following convictions you will not be eligible for the scheme:

Any conviction which has resulted in a ban in the last 5 years (including any of the minor conviction codes above).

A conviction in the last 5 years with any of the following letters on your licence:

AC – BA – CD – DD – DG – DR – IN – MS – TT - UT

What are my responsibilities for the car?

It will be your responsibility to ensure that the vehicle is in a roadworthy and legal condition. This may involve you regularly checking its condition and following the appropriate channels to complete any maintenance or repair work.

Depending on your employer there may be additional duties that you will have to perform but these will be outlined to you when you join the scheme.

Will joining the scheme affect the terms and conditions of my employment?

Yes. We will amend these in accordance with Section 4 of the Employment Rights Act 1996. You will be agreeing to these changes when you sign the salary sacrifice agreement.

Will a salary sacrifice car affect my credit?

You will not undergo any credit checks to join the scheme so there will be no impact in terms of credit searches.

However, your salary will be reduced by the salary sacrifice arrangement, which means the amount you are eligible to borrow could be affected.

Will my student loan be affected?

This will depend on how your employer treats your sacrifice and whether they use your salary pre- or post-sacrifice to calculate deductions like student finance. We recommend speaking with your employer to confirm how this will work for you.

How does salary sacrifice affect pensions?

Again the answer to this will depend on how your employer calculates pension contributions and whether they use your notional salary or post sacrifice salary to do so. You should speak to your employer about this to confirm any impact before you join the scheme.

What happens at the end of the agreement?

We will be in touch with you three to six months before the end of the contract to discuss your options. We will then work towards a smooth handover if you want a replacement car.

If there is any damage considered to be above fair wear and tear, you will be responsible. We follow the British Vehicle Rental and Leasing Association (BVRLA) guidelines, and we can provide information on what may be chargeable. If repairs are needed you can decide whether to get them done prior to collection or pay the invoice from your employer.

You will also be charged for any excess miles above the mileage allowance on your lease contract. This will also be charged through your employer at the end of the contract. There is no option to buy the car at the end of the lease, but you may be able to extend the lease in certain cases.

What if I leave the company or stop driving before the end of the agreement?

The cost of handing back the car early will be covered by Early Termination Protection in most cases. The lease agreement will need to be in place for a minimum period, known as the ‘deferral period’ for this protection to apply:

• Resignation (6 months deferral period)

• Parental leave (9 months deferral period)

• Long term sickness absence (3 months deferral period)

• Accidental death (no deferral)

• Loss of driving licence (on medical grounds)

A car provided through a salary sacrifice scheme, in the same way as a company car, is subject to company car Benefit in Kind (BIK), calculated by taking the P11D value of the vehicle and using the CO2 emissions to apply a percentage charge.

The reason salary sacrifice works so well for fully electric vehicles is that CO2 emissions are zero, so the lowest tax charge applies. This is just 3% until 31 March 2026 and is set to increase by 1% a year until 2028, after which the Government will review it.

For example, if the P11D value is £30,000. The 3% BIK amount is £900 for the year. You then apply your relevant tax band. A 40% taxpayer, for example, will pay £360 for the year or £30 per month.

Discover how Wessex Fleet can offer salary sacrifice to your employer

Speak to an expert