EVs for High-Mileage Drivers

How to get an EV that covers enough miles

It’s easy to set up and manage. Reward your employees and reduce your fleet carbon footprint while saving money.

We can discuss the types and numbers of vehicles you want to include.

We’ll introduce a scheme that’s perfectly tailored to your business needs.

Our dedicated team and comprehensive portal have got you covered.

Employees can log into the portal, browse a range of electric vehicles and customise their leases, selecting annual mileage, lease duration etc. They can also choose optional extras such as paintwork, wheels, and driver convenience features to tailor the vehicle.

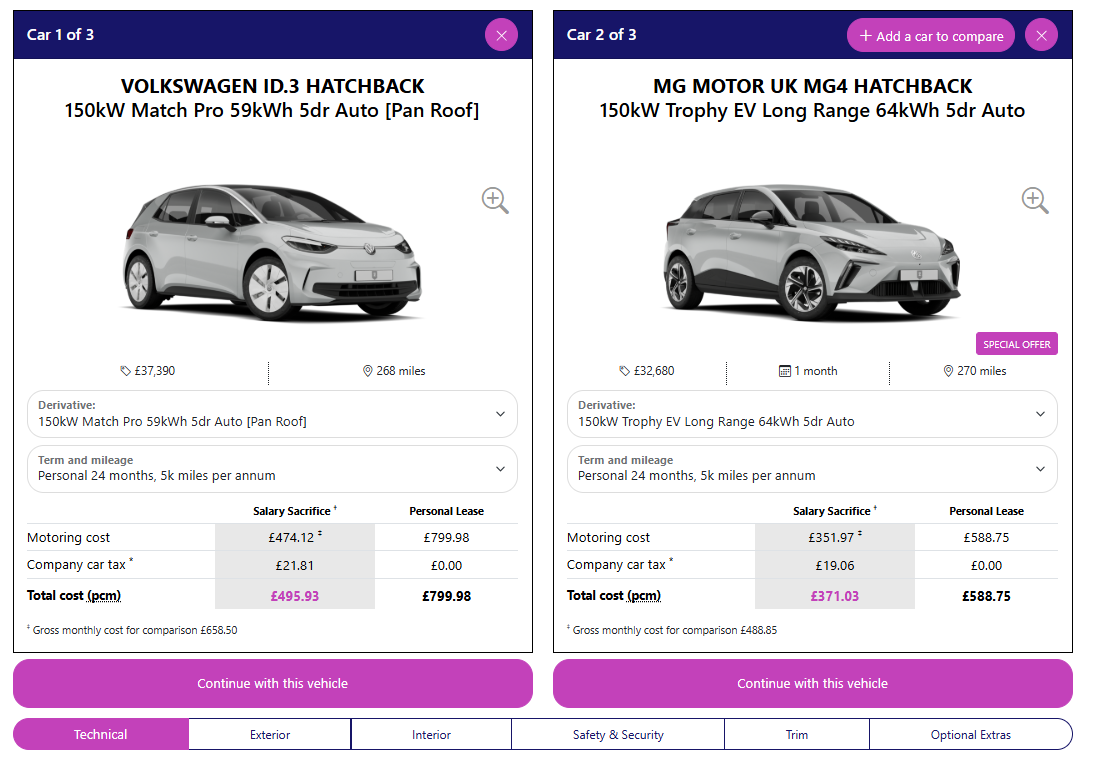

The platform includes a savings calculator that shows how much employees save through salary sacrifice on a selected vehicle compared to other models they're interested in. It lists the features, costs and savings on multiple vehicles side-by-side, so they’re easy to compare.

Your dashboard will give you an overview of where your employees are in the ordering process, pinpointing how many still need to select vehicles, how many are awaiting agreements, the ones you’re awaiting agreements back from and the vehicles on order and delivered.

You get notified of any driver quotes, and can approve their orders. You’ll receive updates on their orders once approved. The completed order will then automatically come through to us to process for you.

Boost recruitment and retention by enhancing your total benefits package, providing an “all employee” benefit.

Reduce the carbon footprint of your employees, encouraging drivers away from older grey fleet vehicles.

Our multi-bid funding solution is similar to a competitive tender, driving the best prices through an extensive panel of funders.

Take advantage of our free whole life cost analysis to calculate cost savings before you decide which vehicles to offer.

You’ll receive a dedicated account contact, and we’ll handle all the administration for your scheme.

Businesses and their drivers get access to our intuitive portal and calculator, allowing them to compare quotes, view order details and sign contracts.

1. Register your interest

Let us know you're interested in the details of our bespoke salary sacrifice scheme

2. We’ll be in touch

One of our dedicated team of experts will contact you to discuss the scheme. We’ll set up tailored parameters regarding eligibility and so forth, find out more about the cars you’d like to offer and give you insight into the models that make the best financial sense for your business.

3. Simple paperwork

e-Sign your EV salary sacrifice documents which we'll send straight to your inbox are there any other stages that fall between this one and the one above? Can we also have more details here on this stage?

4. Launch to your employees

Once you’ve accepted the scheme, we share it with your eligible employees, who can then choose a car from the portal. You approve their selection (or not), and we have the ability to carry out affordability checks if required. We order the car, ensure it’s delivered to the employee, and provide you with all the necessary payroll information.

What’s included in our salary sacrifice scheme?

Which employees are eligible?

You can set your company’s criteria for joining and decide which employees you would like to offer the scheme to. Our requirements are as follows:

What setup costs are involved?

Our scheme has no setup costs and we handle all the necessary administration too.

What payroll support is included?

We provide all payroll administration including monthly benefit calculations, P46 car forms, P11D preparation, and clear payrolling instructions. Our dedicated support team and portal ensure the scheme integrates with your existing payroll processes.

How much do employers save on NI contributions?

Employers save 15% National Insurance on the salary sacrificed amount and that’s on top of employees’ Income Tax and National Insurance savings, ensuring savings for both parties. You can share this saving with employees too.

How is the BIK tax on salary sacrifice electric cars calculated?

To incentivise the take up of electric cars the BIK tax charge on company cars decreases in line with carbon emissions. The lowest BIK rate applies to vehicles with zero C02 emissions, or emissions of less than 50g per km and an electric range of more than 130 miles. The rate is set at 3% until April 2026, after which it will increase by 1% each year until 2028.

Since the company car BIK tax is calculated on the P11D value (based on the list price including VAT and delivery charges), if the PD11 value of a zero emission vehicle is £30,000, the BIK rate would be 3% of this or £900 for the year. For the employee, their tax band is applied so a 40% taxpayer would pay £360 for the year or £30 per month.

Who is responsible for a salary sacrifice car?

The lease contract and all associated services are in the name of your business, rather than the employee. However, it will be a joint responsibility between you and your employees for ensuring that their vehicle is kept in a roadworthy and legal condition, and for getting any necessary maintenance or repair work completed.

How does servicing and maintenance work?

All salary sacrifice cars are brand-new with a manufacturer guarantee which will last for most, or all, of the lease term.

As part of our scheme we provide all routine servicing and maintenance including breakdown and recovery, as well as tyre replacement through wear and accidental punctures, and we notify the drivers when servicing or MOTs are due.

How many employees need to join the scheme?

You can join with as many or as few as you want. Our scheme works for firms of all sizes, from SMEs to large businesses.

What happens at the end of the contract?

We contact the employee around three to six months before the end of the contract and make sure there’s a smooth transition to a replacement car if needed.

Employees are responsible for any damage beyond fair wear and tear and they can choose whether to pay for repairs themselves or be charged through the scheme. We follow the British Vehicle Rental and Leasing Association (BVRLA) guidelines, and we can provide information on these. There is also a charge if mileage is above the annual mileage that the contract was based on.

Discover how Wessex Fleet can offer salary sacrifice to your employees

Speak to an expert